Adrian Portelli's 'The Block' giveaway hits tech issue – realestate.com.au

[ad_1]

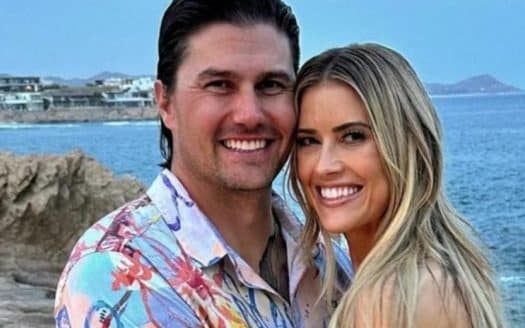

Adrian Portelli tries to get things going live.

Australian billionaire Adrian Portelli's plan to give away all five properties in The Block's 2024 season has turned into a frenzy after technical issues delayed the announcement of the winner.

Portelli planned to award all five properties, or $8 million, to one lucky winner in a lottery run by LMCT+.

The winner's draw scheduled for 20:30 on Boxing Day has not been successful.

Portelli explained to the 75,000 people watching live on Facebook that the volume of traffic caused the LMCT+ systems to crash.

At the development site at Phillip Isand, Portelli was left to chew live time on camera as his team unsuccessfully worked to restore systems.

MORE:

Adrian Portelli looks on at one of The Block 2024 auctions. Photos: Channel 9

Portelli said that the draw will now be held on December 27.

The Block Giveaway is one of the richest competitions outside of traditional lotteries in Australian history.

Portelli launched the competition in November after The Block's 2024 season finale and bought all five properties for a staggering $15 million.

So when the final winner is chosen, which is better: Houses or money?

We asked the experts, and they said so.

OPTION 1: Buy and sell houses

If you decide to own all the houses, but then try to sell them to yourself with the “celebrity” appeal of owning a TV property, you could theoretically sell them all for more than the $8 million in prize money on offer.

But will buyers clamor to buy them?

The “glamour” of owning The Block's Phillip Island homes was questioned by Property Home Base founding director and buyers' agent Julie DeBondt-Barker.

“They don't accurately represent investment properties, it's a reality set up to serve entertainment,” Ms. DeBondt-Barker said.

“There is often a disconnect between television stories and the fundamental requirements of real estate investing.

“Proper financial planning through hedge funds and ensuring the right ownership structure is essential to effectively manage any tax implications.”

MORE:

Adrian Portelli celebrates with The Block winners Maddy and Charlotte. Photos: Channel 9

Eview Real Estate director and Phillip Island expert Teresa Young said over the years homes on The Block have been criticized for being overpriced.

“While they feature impressive designs and modern amenities, their price tags often exceed what many would consider reasonable in the current market,” Ms Young said. “Phillip Island is home to countless beautiful beaches, each offering a unique experience – there are numerous tourist attractions, as well as a variety of pubs catering to the influx of visitors looking for relaxation and entertainment.

“Given The Block's property purchases, if I were to invest, my approach would involve ensuring that the properties are strata-titled – which means dividing the property into separate units that can be sold individually – thus potentially increasing rather than protecting the financial return. can as a single asset.”

Ms. Young also said that capital gains taxes would also apply on the sale, and $8 million would likely not be refunded if the homes were sold individually.

“I can't comment on what they'll sell for individually, but they probably won't sell for what they did on The Block,” he said.

OPTION 2: Take the houses and rent them out

If you decide to keep the houses and rent them out, will there be a worthwhile return?

The average price of a four-bedroom rental house in Cowes is $540 a week, according to PropTrack data.

Using this assumption, properties in total could generate $140,400 per year in rental income.

Industry Insider Property buyers agent Andrew Date said the decision depended on wider economic, legislative and personal factors.

MORE:

Island Cove Villas on Phillip Island has been acquired by The Block for the 2024 season.

“When you're advising someone whether to take cash or a house, it really depends on their financial literacy and their understanding of business, profit and loss,” Mr Date said.

“The potential to offset tax liabilities by structuring property ownership through family trusts offers another layer of strategic complexity – structuring property ownership within a family trust can actually be a more tax-efficient way to avoid large estate tax payments by allocating property to family members. . .”

Mr Date said thinking about broader economic policy included the reality facing a potential winner.

“I think if we want to see the market improve next year, it may require a change in government and housing policy, because the current policies are leading investors to liquidate their assets. In order to increase the confidence of buyers, the interest rates should also decrease consistently.

But even if you build the property right, will they make money?

Serial Block claimant Danny Wallis highlighted his concerns about attempts to rent these particular properties separately.

Mr Wallis previously told The Herald Sun he saw no point in bidding for the houses on auction day against Portelli.

While he said the homes were of good quality, he thought they were clearly built as vacation homes and best suited to be listed for short-term rentals.

MORE:

Maddy and Charlotte watch their auction progress in the 2024 finale. Photo: Channel 9

“I liked the houses on Phillip Island, but one of the reasons I didn't make a hard offer was because there was a lot of uncertainty with taxes and all of that on Airbnbs,” he said.

“And if you rent them out as a year-round vacation home, you're not going to make a huge profit. “They are not really close to the beaches.”

“They don't accurately represent investment properties, it's a reality set up to serve entertainment,” Ms. DeBondt-Barker said.

“There is often a disconnect between television stories and the fundamental requirements of real estate investing.

“Proper financial planning and ensuring the right ownership structure through test funds is essential to effectively manage any tax implications.

“Proper financial planning and ensuring the right ownership structure through hedge funds is essential to effectively manage any tax implications.

OPTION 3: Take cash

Zac Newbold, your Australian Property buyer's agent, said the cash option was in line with the current economic uncertainties. “In today's market, where property prices are more influenced by current trends than intrinsic value, the security of cash is very attractive,” Mr Newbold said.

“I'd probably take $8m in cash over the house – I think that sentiment reflects increased caution in a market under pressure from volatile regulatory changes.”

But he has some words of caution, especially for those looking to turn these properties into a profitable business through platforms like Airbnb.

MORE:

Portelli's love of luxury cars has earned him the nickname “Lambo Boy” by the Australian public. Photo: Instagram

Mr Newbold said the idea of buying Phillip Island homes and setting up a business had been hampered by Victorian government levies such as the Airbnb tax and land tax.

“Together with legislative changes like the 7.5 percent levy, it doesn't seem right to me,” he said.

“One of my clients has an unencumbered property in Sorrento and is already spending about $80,000 a year on taxes alone.

“Many of my investor clients are now considering buying property in other states, reflecting the trend toward lower tax burdens and better investor climates elsewhere.”

Anyone interested in building a property portfolio would be better off taking cash and investing in states other than Victoria where the new taxes are not an issue.

DOCTOR

Teresa Young, CEO of Eview Real Estate, said taking the cash was the best financial decision.

“If given the opportunity, I would choose to take the $8 million in a context where a significant financial decision had to be made,” Ms Young said.

“The property market is very active, partly due to various financial pressures – there are other homes in Phillip Island that you can make a much healthier investment.”

“The residential real estate market presents various opportunities.

“There is a wide selection of homes that appeal to buyers in the $600,000s and under.”

The other bidders were stunned to learn that Portelli won every auction. Photo: Channel 9

Ms Young said properties priced under $600,000 could also attract interest from entry-level holiday home seekers.

However, properties in higher price brackets present more sales challenges because the pool of buyers is smaller and more selective, often requiring more persuasive sales tactics or price promotions.

Industry Insider Property buyers agent Andrew Date agreed.

“I prefer to take cash, hedge my bets by putting half in fixed income and use the other half to buy a primary residence,” Mr Date said.

“This strategy is based on the pragmatism of using capital gains tax exemptions that can generate significant financial benefits over time.”

[ad_2]

Table of Contents