How 7% mortgage rates will change housing in ten years

[ad_1]

in the year data, we track every home sold in the country every week. We can immediately see the speed of these changes.

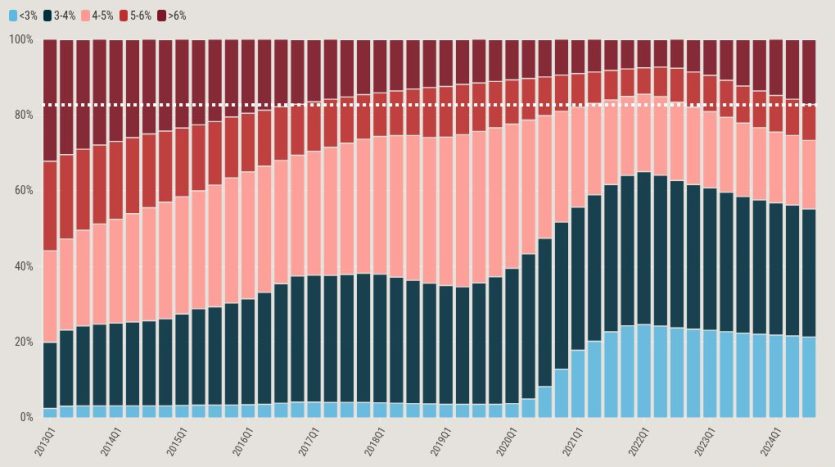

We can see this effect in any number of statistics. Tenure continues to rise. We used to keep the houses for seven years, but now it's almost 10 years. The average age of outstanding loans rose steadily during the decade of cheap money, fell during the pandemic frenzy, and is now rising rapidly as homeowners scramble. The average age of all outstanding mortgage loans is now 72 months, up from just 59 months at the end of the pandemic free money boom.

For 30 years, low mortgage rates have kept people in their homes. The opposite is also true: More homeowners want to sell their homes for mortgages.

People with expensive mortgages are more likely to sell their homes. They will sell when it is their primary residence – to finance the next home. They will sell investment properties – where the cash flow is not penned as with a 4% loan. They will unload some properties with very cheap loans to finance the next purchase. The more people with expensive loans, the more home inventory available on the market.

By June of this year, we should expect more than 20% of US borrowers to have mortgages with 30-year fixed rates above 6%—a level not seen in a decade. As mortgage rates rise, we will find ourselves in a market with more and more homeowners with expensive mortgages.

The effect will be felt for years.

The next 5 years

We could end the year with over 10 million homeowners on this expensive mortgage. Compare that to just over 3 million in Q1 2022 as we emerge from the pandemic frenzy. This will be more home sellers when the time comes. Of course, not all of them are ready to sell now. Life events take time to materialize. But with higher rates each year, that means more homes are being sold.

In 2025, we expect unsold home inventory on the market to be very close to 2018 levels. If mortgage rates rise by 2026, we could easily see inventory grow to 1 million or more homes — levels we considered normal a decade ago.

What happens when all these houses are on the market? More options for buyers, for one thing. In the last 10 years, especially, home buyers have been trapped in competitive situations with poor choice and frequent bidding wars. Only the best prepared buyers will win. Over the next few years, this means better opportunities for home buyers who have been fighting for inventory scraps since 2015. The pressure finally eases.

There will be less upward pressure on house prices. Home prices rose steadily across the country – even with lower demand in 2023 and 2024, supply was still so tight in many markets that home prices rose. This trend is now stable for home prices for several more years, perhaps until the end of the decade.

It also means silent capital growth. Buying with a very low down payment will be a riskier period. This will be a period when fewer investors can speculate by buying multiple properties with the capital gains of the existing portfolio.

Since home prices have held steady for several years, this means that incomes will grow faster than home prices, so affordability improves over the rest of the decade. Are stubbornly high mortgage rates our way to finally solve America's affordability crisis? Isn't that an ironic conclusion?

[ad_2]