Loan Modification to Stop Foreclosure: A Lifeline for Homeowners

Loan modification to stop foreclosure has become a buzzword in the real estate industry, particularly for homeowners facing the daunting prospect of foreclosure. In today’s challenging economic climate, many individuals find themselves struggling to keep up with mortgage payments, putting their homes at risk. However, there is hope. By exploring the option of loan modification, homeowners can potentially save their homes from foreclosure and regain financial stability.

The concept of loan modification to stop foreclosure is simple yet powerful. It involves renegotiating the terms of a mortgage to make it more affordable for the borrower. This can be achieved through various means, such as reducing the interest rate, extending the loan term, or even forgiving a portion of the principal balance. The goal is to create a new payment plan that aligns with the homeowner’s current financial situation, making it easier for them to meet their obligations and avoid foreclosure.

One of the key advantages of loan modification to stop foreclosure is its potential to halt the foreclosure process. When a homeowner falls behind on mortgage payments, the lender may initiate foreclosure proceedings to recover their investment. However, by actively pursuing loan modification, homeowners can put a temporary pause on the foreclosure process, providing them with the opportunity to present their case and negotiate a more manageable repayment plan.

Furthermore, loan modification to stop foreclosure offers a range of benefits beyond foreclosure prevention. It can provide homeowners with the breathing room they need to stabilize their finances, reduce their monthly mortgage payments, and potentially save thousands of dollars in interest over the life of the loan. Additionally, it can improve credit scores, making it easier for homeowners to access future credit and secure their financial future.

In conclusion, loan modification to stop foreclosure is a lifeline for homeowners facing foreclosure. By exploring this option, homeowners can potentially save their homes, regain financial stability, and secure a brighter future. In the upcoming articles, we will delve deeper into the intricacies of loan modification, exploring the eligibility criteria, the application process, and the potential pitfalls to watch out for. Stay tuned for an in-depth exploration of this vital subject matter.

Loan Modification to Stop Foreclosure

Foreclosure can be a distressing experience for homeowners, but there is a solution that can help you keep your home – loan modification. By understanding the process and taking the necessary steps, you can stop foreclosure and regain control of your financial situation.

What is it?

Loan modification is a process where the terms of your existing mortgage are modified to make it more affordable. This can involve reducing the interest rate, extending the loan term, or even forgiving a portion of the principal balance. The goal is to make your monthly mortgage payments more manageable, allowing you to avoid foreclosure.

How to Initiate Loan Modification to Stop Foreclosure

To start the loan modification process, you will need to gather all the necessary documentation, including pay stubs, bank statements, and tax returns. It’s important to provide accurate and up-to-date information to your lender to increase your chances of success. Once you have all the required documents, you can submit a loan modification application to your lender.

It’s crucial to communicate effectively with your lender throughout the process. Be proactive in providing any additional information they may request and promptly respond to their inquiries. Keeping the lines of communication open will help ensure a smooth and efficient loan modification process.

Explore all Available Options

During the loan modification to stop foreclosure process, it’s also essential to explore all available options. Your lender may offer programs specifically designed to assist homeowners facing foreclosure. Additionally, there are government programs such as the Home Affordable Modification Program (HAMP) that can provide further assistance.

In conclusion, loan modification to stop foreclosure is a viable option to save your home. By following the necessary steps, providing accurate information, and staying in touch with your lender, you can increase your chances of success. Remember to explore all available options and seek professional advice if needed. Don’t lose hope – loan modification can help you regain control of your financial future.

Eligibility Requirements

Loan modification to stop foreclosure can be a valuable tool for homeowners facing the threat of foreclosure. It offers a lifeline to those who are struggling to keep up with their mortgage payments. However, not everyone is eligible for a loan modification. There are certain requirements that homeowners must meet in order to qualify for this assistance.

Demonstrate a Financial Hardship

One of the key eligibility requirements is demonstrating a financial hardship. This means that the homeowner must prove that they are experiencing a significant decrease in income or an increase in expenses that makes it difficult for them to afford their mortgage payments. Examples of financial hardships include job loss, divorce, medical emergencies, or a death in the family.

Mortgage Must be at Risk of Default

Another requirement is having a mortgage that is in default or at risk of default. This means that the homeowner must be behind on their mortgage payments or in danger of falling behind. Lenders are more likely to offer loan modifications to homeowners who are proactive in seeking assistance before they fall too far behind on their payments.

Demonstrate Ability to Satisfy Modified Payments

Additionally, homeowners must be able to demonstrate their ability to make modified mortgage payments. This involves providing proof of income, such as pay stubs or tax returns, to show that they have the means to afford the new payment amount. Lenders want to ensure that homeowners will be able to sustain the modified payment over the long term.

Meet Eligibility Requirements

Lastly, homeowners must have a mortgage that is eligible for modification. This means that the loan must be owned or guaranteed by a government-sponsored enterprise, such as Fannie Mae or Freddie Mac, or insured by the Federal Housing Administration (FHA).

Meeting these eligibility requirements is crucial for homeowners seeking a loan modification to stop foreclosure. By understanding and fulfilling these criteria, homeowners can increase their chances of obtaining the assistance they need to save their homes.

Application Process

When facing the threat of foreclosure, applying for a loan modification can be a lifeline that helps you keep your home. The application process may seem daunting, but with the right knowledge and preparation, you can navigate it successfully.

1. Gather all the Necessary Documentation

To begin the application process, gather all the necessary documentation. This typically includes proof of income, bank statements, tax returns, and a gather all the necessary documentation explaining why you need the loan modification. Be thorough and organized, as missing or incomplete documents can delay the process.

2. Submit Application for Loan Modification

Once you have all the required paperwork, contact your mortgage servicer or lender to initiate the application. They will provide you with the necessary forms and guide you through the process. It’s crucial to maintain open communication with them throughout the application process.

3. Lenders Review of the Application

After submitting your application, the lender will review your financial situation and assess your eligibility for a loan modification. They will evaluate factors such as your income, expenses, and the value of your home. This review process may take some time, so it’s important to be patient.

During the review process, it’s essential to continue making mortgage payments to show your commitment to resolving the situation. Some lenders may offer a trial period plan, where you make reduced payments to demonstrate your ability to meet the modified terms.

4. After Approval of Modification

Once your application is approved, you will receive a loan modification agreement outlining the new terms. Carefully review the agreement and seek legal advice if needed. Once you sign the agreement and fulfill any additional requirements, the foreclosure process will be halted, and you can begin making payments according to the modified terms.

Important Considerations

Remember, the application process for a loan modification can be complex, but with perseverance and proper documentation, you can increase your chances of success. Seek assistance from housing counseling agencies or legal professionals specializing in foreclosure prevention to ensure you navigate the process effectively.

By understanding the application process and taking the necessary steps, you can increase your chances of obtaining a loan modification and stopping foreclosure. Stay proactive, communicate openly with your lender, and seek professional guidance to protect your home and financial future.

Required Documentation

When facing the possibility of foreclosure, loan modification can be a valuable option to explore. However, the process can be complex and requires careful attention to detail. One crucial aspect of loan modification is ensuring you have all the necessary documentation in order. By providing the required documentation, you can increase your chances of successfully stopping foreclosure and securing a modified loan agreement.

Proof of Income

To begin the loan modification to stop foreclosure process, you will typically need to provide proof of income. This can include recent pay stubs, tax returns, and bank statements. Lenders want to ensure that you have a stable income and can afford the modified loan terms. Additionally, you may need to provide documentation of any other sources of income, such as rental properties or investments.

Financial Statements

Next, you will need to gather your financial statements. This includes a detailed list of your monthly expenses, such as rent or mortgage payments, utilities, and other recurring bills. You may also need to provide documentation of any outstanding debts, such as credit card statements or loan agreements.

Hardship Letter

In order to demonstrate your financial hardship, you may be required to provide a hardship letter. This letter should explain the circumstances that have led to your inability to make your current mortgage payments. It is important to be honest and provide as much detail as possible. Lenders want to understand your situation and determine if a loan modification is a viable solution.

Submit Loan Modification Application

Finally, you will need to complete and submit the necessary application forms. These forms will vary depending on your lender, but may include a loan modification application, financial disclosure form, and authorization to release information.

Loan Modification Options

When facing the possibility of foreclosure, homeowners often seek loan modification options as a way to save their homes. Loan modification to stop foreclosure is a process that allows borrowers to negotiate with their lenders to make changes to their existing mortgage terms. By modifying the loan, homeowners can potentially reduce their monthly payments and make them more affordable. Let’s explore some of the loan modification to stop foreclosure options available.

Follow up With Your Lender

By gathering and submitting all the required documentation, you can streamline the loan modification process and increase your chances of success. Remember to keep copies of all documents for your records and to follow up with your lender to ensure they have received everything they need. Loan modification can be a complex process, but with the right documentation, you can take a significant step towards stopping foreclosure and securing your financial future.

Extend the Term of the Loan

One common option is to extend the loan term. By extending the length of the loan, borrowers can spread out their payments over a longer period of time, which can result in lower monthly payments. This can be particularly helpful for homeowners who are experiencing temporary financial hardship but expect their income to improve in the future.

Lower the Interest Rate

Another option is to lower the interest rate. By negotiating a lower interest rate with the lender, homeowners can reduce the overall cost of their mortgage. This can make a significant difference in monthly payments and help homeowners avoid foreclosure.

Principal Reduction

Some borrowers may also qualify for a principal reduction. In this case, the lender agrees to reduce the total amount owed on the mortgage. This can be a more challenging option to obtain, but it can provide substantial relief for homeowners who owe more on their mortgage than their home is currently worth.

Loan Forbearance

Additionally, loan forbearance is another option to consider. With forbearance, the lender agrees to temporarily suspend or reduce the monthly payments for a specified period of time. This can give homeowners the opportunity to get back on their feet financially before resuming regular payments.

Explore all Options and Communicate with the Lender

It’s important for homeowners to explore all available loan modification options and work closely with their lenders to find the best solution for their specific situation. By taking proactive steps to modify their loans, homeowners can potentially stop foreclosure and keep their homes. Remember, seeking professional advice from a housing counselor or attorney can also be beneficial in navigating the loan modification process.

In conclusion, loan modification options provide homeowners with a lifeline when facing foreclosure. By extending the loan term, lowering the interest rate, obtaining a principal reduction, or exploring loan forbearance, homeowners can find a solution that fits their needs and helps them avoid losing their homes.

Impact on Credit Score

Loan modification to stop foreclosure can be a lifeline for homeowners facing foreclosure. It offers a way to restructure the terms of their mortgage, making it more affordable and allowing them to keep their homes. However, many people are concerned about the impact that loan modification can have on their credit scores. In this article, we will explore the effects of loan modification on credit scores and provide insights into what homeowners can expect.

Will a Loan Modification Hurt My Credit Score?

One of the biggest misconceptions about loan modification is that it will automatically damage your credit score. While it is true that the process may have some short-term negative effects, the long-term benefits can outweigh the initial impact. When you first apply for a loan modification, it may temporarily lower your credit score due to the financial hardship you are experiencing. However, as you start making regular payments under the modified terms, your credit score will gradually improve.

What are the Factors Impacting My Credit Score?

It’s important to note that the impact on your credit score will depend on your current financial situation and credit history. If you have a good credit score before seeking a loan modification, the impact may be less severe compared to someone with a lower credit score. Additionally, if you continue to make timely payments on your modified loan, your credit score will gradually recover.

What is the Risk-benefit Ratio Impact on My Credit Score?

Another factor to consider is that loan modification can be a better alternative to foreclosure, which can have a devastating impact on your credit score. Foreclosure stays on your credit report for seven years and can significantly lower your credit score, making it difficult to obtain future loans or credit.

Credit Impact Key-points

In conclusion, while loan modification may initially have a negative impact on your credit score, it can ultimately be a positive step towards avoiding foreclosure and preserving your home. By making timely payments and demonstrating financial responsibility, you can gradually rebuild your credit score over time.

Foreclosure Prevention Resources

If you’re facing the possibility of foreclosure, it’s important to know that there are resources available to help you. Loan modification is one option that can potentially stop foreclosure and allow you to keep your home. By making changes to your mortgage terms, such as lowering your interest rate or extending the length of your loan, you may be able to make your monthly payments more affordable.

Government Resources

There are several organizations and government programs that offer assistance with loan modification. The Department of Housing and Urban Development (HUD) provides counseling services and can help you understand your options. They can also connect you with approved housing counseling agencies in your area.

Another resource to consider is the Making Home Affordable (MHA) program, which was created by the federal government to help struggling homeowners. This program offers loan modification options as well as other foreclosure prevention solutions. You can contact the MHA program directly or work with a HUD-approved housing counselor to explore your eligibility.

Bank and Mortgage Lender Resources

In addition to these programs, many banks and mortgage lenders have their own loan modification programs. It’s important to reach out to your lender as soon as possible to discuss your situation and see what options may be available to you. They may require documentation such as income verification and a hardship letter to evaluate your eligibility.

Remember, time is of the essence when it comes to foreclosure prevention. The sooner you take action and explore your options, the better chance you have of finding a solution that works for you. Don’t hesitate to reach out to the resources mentioned above and seek professional guidance if needed.

By utilizing these foreclosure prevention resources, you can increase your chances of stopping foreclosure and keeping your home. Take advantage of the assistance available to you and take proactive steps to protect your property.

Frequently Asked Questions

What is loan modification?

Loan modification is a process that allows homeowners to make changes to their existing mortgage terms in order to prevent foreclosure. This can involve lowering the interest rate, extending the loan term, or reducing the principal balance.

How does loan modification help to stop foreclosure?

Loan modification can help stop foreclosure by making the monthly mortgage payments more affordable for homeowners. By negotiating with the lender, borrowers can find a solution that allows them to stay in their homes and avoid foreclosure.

Who is eligible for loan modification?

Eligibility for loan modification depends on various factors, including the homeowner’s financial situation, the value of the property, and the lender’s guidelines. Generally, homeowners who are facing financial hardship and can demonstrate their ability to make modified payments are more likely to qualify for loan modification.

What are the benefits of loan modification?

Loan modification offers several benefits for homeowners, including the ability to avoid foreclosure, reduce monthly mortgage payments, and potentially save their homes. It can also help improve credit scores and provide a fresh start for homeowners who are struggling with their mortgage payments.

How long does the loan modification process take?

The duration of the loan modification process can vary depending on various factors, such as the complexity of the case and the responsiveness of the lender. In some cases, it can take several months to complete the process. It is important for homeowners to stay proactive and follow up with their lenders to ensure a timely resolution.

Can I apply for loan modification multiple times?

Yes, homeowners can apply for loan modification multiple times if their financial situation changes or if they were initially denied. It is important to provide updated financial information and demonstrate the need for modification each time.

Remember, seeking professional advice from a loan modification expert or housing counselor can greatly assist you in navigating the loan modification process and increasing your chances of success.

In conclusion, this post has covered various important topics related to “”loan modification to stop foreclosure””. We have discussed the process of loan modification and its significance in preventing foreclosure.

Summary

Firstly, we explored the eligibility requirements for loan modification to stop foreclosure, emphasizing the importance of demonstrating financial hardship and the ability to make modified payments. We also highlighted the application process and the need for timely submission of all required documentation.

Furthermore, we delved into the different loan modification options available to homeowners, such as interest rate reduction, loan term extension, or principal forbearance. Understanding these options can help borrowers choose the most suitable modification plan for their specific situation.

We also addressed the impact of loan modification to stop foreclosure on credit scores. While it may initially have a negative effect, successfully completing a loan modification program can ultimately improve creditworthiness and financial stability.

To assist homeowners in their journey to stop foreclosure, we provided information on foreclosure prevention resources. These resources offer guidance, counseling, and legal assistance to individuals facing the threat of foreclosure.

Lastly, we addressed frequently asked questions, providing clarity on common concerns and misconceptions surrounding loan modification and foreclosure prevention.

It is crucial to recognize the importance of loan modification in preventing foreclosure and preserving homeownership. By taking proactive steps and seeking assistance when needed, individuals can navigate through financial challenges and secure a better future for themselves and their families.

Recommendations Going Forward

Looking ahead, it is essential to stay informed about any future developments or trends that may impact loan modification and foreclosure prevention. Changes in government policies, economic conditions, or lending practices can influence the availability and effectiveness of loan modification programs.

Thank you for taking the time to read this post. We hope that the information provided has been helpful in understanding the topic of loan modification to stop foreclosure. We encourage you to leave any comments or feedback, as your input is valuable to us. Remember, taking action now can make a significant difference in your journey to prevent foreclosure and secure your home.

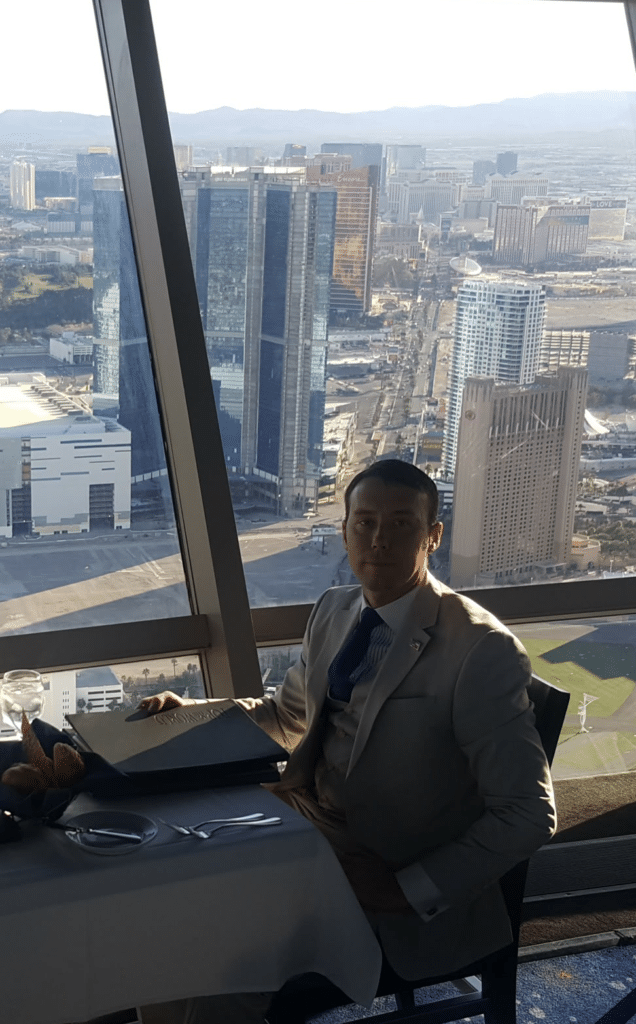

About Justin Mitchell

Justin, the owner and operator of “We Buy Houses In WDVM,” is a seasoned professional with a knack for providing solutions to individuals looking to sell their homes or investment properties quickly, regardless of the circumstances.

With a wealth of experience in various buying and selling scenarios, Justin excels at simplifying transactions and ensuring a stress-free process for all parties involved.

Whether you’re seeking a swift cash purchase or exploring alternative selling solutions, Justin is dedicated to finding a win-win outcome for you. As a legitimate house buyer,

Justin boasts a stellar rating on Google Reviews, a testament to his commitment to customer satisfaction.

Visit his “Beat Any Offer” page to understand why he values presenting sellers with concrete facts over mere opinions. Discover why he believes that facts matter most when it comes to creatively selling a house fast.

Table of Contents